Last year, largely from financial pressure arising out of the COVID-19 response, the Federal and State Governments introduced hefty stimulus packages for businesses and individuals.

For many, these have helped prop up their financial viability throughout 2020. However, with those packages largely coming to an end now in 2021 many have been predicting that large numbers of companies were going to become insolvent swiftly in the new year.

So it wasn’t too surprising to hear late last year that the Federal Government had some ideas about how it was going to manage that process.

Enter: insolvency reform.

What’s The New Insolvency Regime in Australia?

There are two main pieces to the new insolvency regime introduced in late 2020 that came into force on 1 January 2021:

- A new system for small businesses that are in distress (but still viable) to restructure and continue to trade; and

- For those that cannot restructure successfully, a simplified liquidation process.

The New Restructuring Process

The idea of the new insolvency system is that directors maintain a lot more control over the restructuring process than in previous Australian scenarios which traditionally involved control being given to an insolvency practitioner.

To use the new process, the company needs to have liabilities (other than contingent liabilities) of less than $1m. The company cannot use the new restructuring system twice, and cannot use it if any of the current (or sometimes former) directors have used the process in another company within the last 7 years. The company also cannot currently be undergoing any of the other forms of insolvency.

To start the new process, a company needs to resolve that:

- it reasonably suspects that it is currently insolvent or is likely to be in the future;

- a small business restructuring practitioner be appointed.

Then, a “small business restructuring practitioner” will quickly (less than 20 business days) help to produce a restructuring plan for a distressed business. Creditors then have 15 business days to vote on the plan, and if accepted then it will be put in action.

To accept a proposal, more than 50% of creditors by value (ie – how much they are owed) have to approve the plan. Related parties can’t vote. All creditors will be bound by it, whether or not they voted.

If not accepted, the business will enter the “simplified” liquidation process.

During this entire process the business can continue to trade while the plan is being developed and voted upon.

Small Business Restructuring Practitioners (SBRPs)

For the moment, only registered liquidators may consent to act as SBRPs, and they need to be sufficiently independent from the company to do so (for example, they cannot be a debtor or creditor of the company over certain limits, nor an auditor or partner/employee of an auditor of the company).

In essence, the SBRP will be given the necessary powers to investigate the company’s affairs so that they can assist with the restructuring plan, determine creditor’s proper claims and resolve any issues that arise, or do anything necessary to let them perform their functions as a SBRP.

The Simplified Liquidation Process

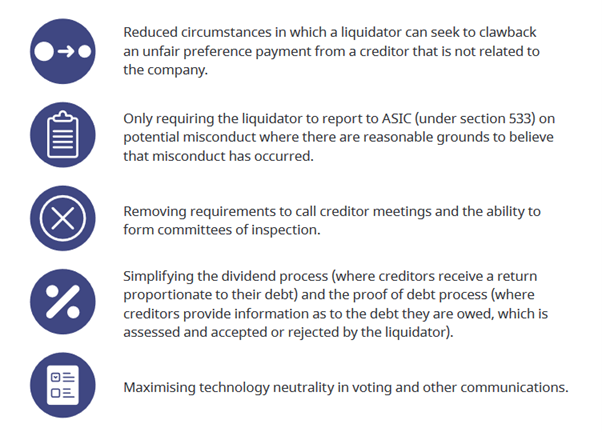

The liquidation process is extremely similar to the current one, with a few bits and pieces removed here and there. Specifically, the government suggests that there are:

- fewer reporting requirements;

- fewer meeting requirements;

- a simplified dividend process.

Here’s a screen grab from the government handout which sets out the basics:

Some of these points are not particularly different from the existing process. We won’t try and guess what “maximising technology neutrality in voting and other communications” means.

Tips for Companies in Financial Distress

First and foremost, don’t assume that the new regime is necessarily the best option. It might have many positive attributes and sound like the best way to move forward, but that isn’t necessarily the case.

Before deciding on a course of action, always get legal advice from an insolvency lawyer – they can then connect you with an insolvency accountant if necessary.

If you do decide to try the new restructuring system, take some time to understand or get advice on what you can and cannot do during the restructuring period. For example:

- you may not generally (without the SBRP’s consent) enter into transactions during the restructuring period other than in the ordinary course of business;

- any attempt to change control or ownership of the company during the restructure will be void.

Next, be aware that the end decision is up to your creditors. If your creditors do not like the restructuring plan, they can vote against it. If they do, your company will go into liquidation. Communication and relationships with your creditors are as important under the new regime as they are with the current administration and restructuring process.

Tips for Dealing with a Company “Under Restructuring”

If you are a dealing with a company that decides to go into the new restructuring process, you should know about it. Most likely you’ll find out:

- by getting a notice of the proposed restructuring plan, if you are a creditor; or

- because when the company enters the new process, the company is obliged to identify itself as Company Pty Ltd (restructuring practitioner appointed).

So what should you do?

First, you need to be careful about terminating your contract. Just because you have a clause that says you can, doesn’t mean you actually can. There are laws in place (that now include the new regime) which prevent parties from terminating a contract if the only reason is that the company is entering the new restructuring process.

Next, unlike the normal administration process, debts incurred by the company during restructuring are… normal. That is, the SBRP will not have any personal responsibility for those debts.

If you were pursuing a company by attempting to wind it up, you might find that your application is going to get adjourned while the restructure is given a chance to unfold.

If you are a secured creditor (that is, you have an enforceable security of some kind) you should get advice ASAP as you only have 13 business days after receiving notice of the restructure to enforce your security.

Will the New Regime Work?

Only time will really tell how successful or otherwise this new regime could be. Many businesses around Australia are likely to be eligible for it, and it might provide an attractive re-entry point for small business to salvage themselves out of short term financial distress.

Practitioners will have to get their heads around the new regime to ensure that they are familiar with the risks and benefits of each path.

Creditors now have yet another form of external administration to try and understand, in a system which was already confusing enough for most people.

The best advice we can give is… get advice. Everyone is new to this system in Australia and there are likely to be some kinks along the way. Don’t let your business be the testing ground without going in to the regime with your eyes wide open.